Business News

The Sunsetting of TCJA of 2017

How Individuals and Businesses Will Be Impacted and Why You Need to Act Now

Written by: Paul Bloodsworth

October 24, 2024

[5 minute read]

Summary

The Tax Cuts and Jobs Act (TCJA) of 2017 brought sweeping changes to the U.S. tax system, lowering corporate taxes, reducing individual income tax rates, and creating new deductions that reshaped financial strategies for millions of Americans.

However, many of the provisions from the TCJA are set to sunset in 2025, which is now just about a year away. This means significant tax changes are coming, and both individuals and businesses need to be prepared.

Understanding the potential impacts and acting now by consulting a financial advisor who incorporates life insurance into tax strategies can help protect against tax increases and ensure your financial future remains secure.

In this article, we’ll explore:

- Key Impacts on Individuals

- Key Impacts on Businesses

- Why You Need an Advisor Now

Key Impacts on Individuals:

What to Expect When the TCJA Sunsets

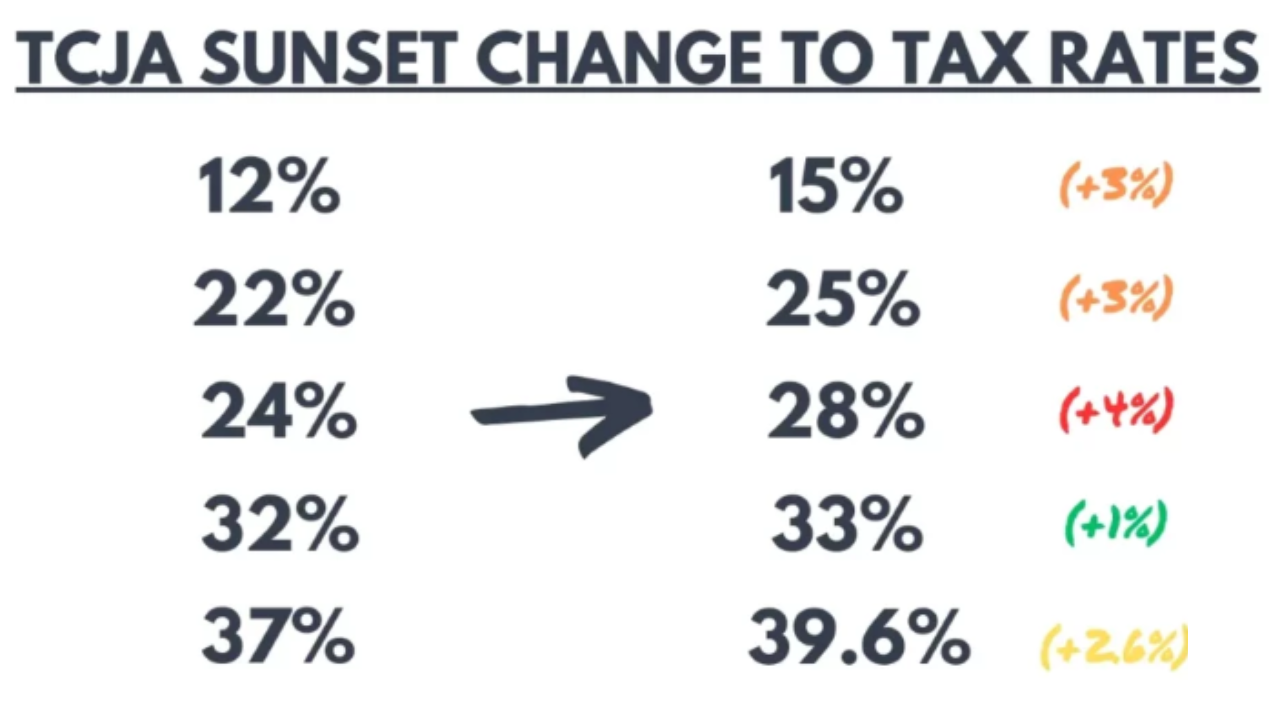

1.) Higher Income Tax Rates

When the TCJA sunsets, individual income tax rates will revert to higher pre-2018 levels. For most taxpayers, this will mean moving into a higher tax bracket. For example, the 22% rate could rise back to 25%, and the 24% bracket could increase to 28%.

- Urgency: With higher taxes looming, now is the time to seek strategies that can help reduce taxable income.

2.) Reduction of the Standard Deduction

The TCJA nearly doubled the standard deduction, offering significant tax savings to those who do not itemize deductions. However, when the TCJA expires:

- The standard deduction for single filers could drop from about $13,850 to roughly half that amount.

- For married couples filing jointly, the deduction would shrink from $27,700 back to pre-TCJA levels.

- This will result in higher taxable income for many Americans, increasing overall tax liabilities.

3.) Child Tax Credit Shrinks

The Child Tax Credit, which currently provides up to $2,000 per qualifying child, will shrink back to $1,000 after the TCJA sunsets. Fewer families will qualify for the full credit due to lower income thresholds, which will directly affect family tax burdens.

3.) Reintroduction of the Personal Exemption

While the TCJA removed the personal exemption, it is set to return after the act sunsets. However, this may not be enough to offset the negative impacts of higher income tax rates and a reduced standard deduction for many families.

Key Impacts on Businesses:

Rising Costs and Strained Resources

1.) Corporate Tax Rate Increase

Under the TCJA, corporate tax rates were cut significantly from 35% to 21%, a move designed to boost business investment and economic growth. When the law sunsets, the corporate tax rate could rise again, increasing the tax burden on businesses.

- Urgency: Higher corporate taxes will reduce profits, leading to lower reinvestment, job cuts, and reduced wage growth. Businesses need to act now to optimize their financial plans and consider ways to mitigate the impact of rising taxes.

2.) End of the 20% Pass-Through Deduction

The TCJA allowed small business owners and entrepreneurs to deduct 20% of qualified business income (QBI). Once the law sunsets, this deduction will be eliminated, resulting in significantly higher taxes for owners of pass-through entities such as LLCs, partnerships, and sole proprietorships.

3.) Reduced Capital Investment Incentives

The TCJA allowed businesses to immediately expense 100% of their investments in equipment and other capital assets through bonus depreciation. This will begin to phase out when the law sunsets, slowing down capital investment in technology, infrastructure, and innovation, and reducing productivity growth.

4.) Increased Taxes on International Profits

The TCJA introduced provisions like the Global Intangible Low-Taxed Income (GILTI) and Base Erosion and Anti-Abuse Tax (BEAT) to prevent U.S. companies from moving profits overseas. If these expire without adjustments, U.S. multinational companies will face higher taxes on their international operations, making it harder to compete globally.

Why You Need a Financial Advisor Now

With the looming tax increases, it's crucial for both individuals and businesses to start planning now. A financial advisor who incorporates life insurance into their strategies can offer significant benefits to mitigate rising tax burdens.

Life Insurance as a Tax-Reduction Tool

Life insurance offers several tax advantages that can help protect your wealth in the face of rising taxes:

- Tax-Free Death Benefits: Proceeds from life insurance policies are generally tax-free, making them an excellent tool for passing on wealth without triggering large tax liabilities.

- Cash Value Accumulation: Permanent life insurance policies allow you to accumulate cash value that grows tax-deferred, which you can access during retirement without affecting your tax bracket.

- Estate Planning: Life insurance can be used to help cover estate taxes, especially if the estate tax exemption drops after the TCJA sunsets, making sure more of your wealth is transferred to beneficiaries.

Call to Action: It's Time to Act

With just over a year left before the TCJA sunsets, the window to take advantage of current tax benefits is closing. Both individuals and businesses will be facing higher taxes, reduced deductions, and stricter rules that could lead to financial strain.

The time to consult a financial advisor is now—one who can help you:

- Maximize existing tax benefits while they last.

- Develop strategies, such as using life insurance, to minimize tax burdens in the future.

- Prepare for the changes to corporate tax rates, deductions, and personal exemptions that will impact your financial outlook.