Business News

Connelly vs. United States "and the IRS"

Here's what happened and why it's important

Written by: Paul Bloodsworth

November 12, 2024

[5 minute read]

Summary

On June 6, 2024, the Supreme Court of the United States unanimously ruled in favor of the IRS regarding life insurance proceeds paid via an entity purchase agreement. The decision came 11 years following the passing of Michael Connelly, majority shareholder of Crown C Supply.

What you should be asking:

- What the heck happened?

- What did they do wrong?

- Was this decision fair?

- What do I need to do to help business owners avoid this happening to them?

This is the opportunity for life insurance advisors. Because of the simplicity and ease of a particular type of buy-sell agreement, most businesses with 3 or more owners use this type. Read below to learn why this type of agreement is no longer a wise choice.

The IRS definition of Estate Tax:

"The Estate Tax is a tax on your right to transfer property at your death."

irs.gov/businesses

What Happened?

Here are some facts and events that occurred leading up to the case:

- Michael owned 77.18% of the company's shares.

- The brother, Thomas Connelly, owned the remaining 22.82% shares.

- The company had a previous valuation at $3.89 million.

- Within the succession plan was an entity-purchase agreement funded with $3.5 million life insurance policies on each of the brothers’ lives. (Remember, in an entity-purchase agreement, the corporation is the owner of the policies.)

- The succession plan stated that, in the event of one of the brother’s death, the other brother would have the option to purchase the decedent’s stake. If the option was not taken, the company would be obligated to use the life insurance proceeds to purchase the decedent’s stake.

- Michael passed away in 2013.

- The surviving brother elected not to purchase directly, so the corporation exercised its obligation to purchase the shares from the decedent’s estate.

- The agreed upon purchase price was $3 million.

- The corporation used $3 million from the life insurance proceeds to purchase the 77.18% shares; the remaining $500,000 was put into the operating account of the business.

- The estate filed an estate tax return showing a value of $3 million for the stake sold.

Filing the Estate Tax Return With the IRS

As the IRS agent reviewed the filing, the agent flagged the return for audit. The basis for the flagging was that the $3 million dollar purchase included no independent appraisal on the value of the shares. With such a large transaction, the IRS wanted to confirm that the buyout was executed according to the succession plan, including an accurate valuation of the shares sold.

Now, life insurance policies historically have not been required to be included in the valuation of a company. When a buy-sell agreement is funded by an entity-purchase agreement, the corporation is the owner of the policy. However, the Connellys’ $3.89 million company valuation did not reflect any future life insurance proceeds.

Even though the life insurance policy is listed in the corporation’s asset column, it is offset as a liability for the corporation’s obligation to purchase the decedent’s shares. The IRS disputed the $3 million value of the purchased shares reported, claiming that the company’s valuation, for estate tax purposes, should have included the value of the insurance proceeds used to purchase the shares.

So, in the eyes of the IRS, the company valuation for estate tax purposes was $6.86 million! With this valuation, the value of the decedent’s 77.18% stake was much larger than the $3 million reported. ($5.29 million)

[ If you’re interested in the math, this impacted the amount of estate tax owed to the IRS to the tune of an additional $889,914. ]

What Went Wrong?

The Connelly’s estate appealed the IRS’s decision. Their basis included 2 primary arguments:

- The entity-purchase agreement stated a “fixed” value of the shares for estate tax purposes, which was set at $3 million (The “agreed” purchase price).

- The obligation for the corporation to purchase the shares created an offsetting liability, thereby canceling out the purchase amount from the asset column.

The lower courts rejected both arguments. The first argument was easily disputed, as there existed a failure on the part of the Connelly’s estate. The courts ruled that the entity-purchase agreement could not be used to preset the value of a company’s shares for estate tax purposes. By the way, the agreement clearly stated that, in the event of a buyout, there was to be one of 2 documents included:

- The Purchase Price determined by a Certificate of Agreed Value; or if this was not in place;

- Two third-party appraisals of the business

Neither of these was submitted with the estate tax return.

However, the second argument was the main event for the fight. The implications around this argument would affect many, many business owners immediately and would set the foundation for all future succession plans. The courts ruled that, for estate tax purposes, a corporation’s obligation to purchase a deceased owner's stake pursuit to a buy-sell agreement does NOT offset the value of life insurance proceeds paid to the corporation.

The case made it all the way up through the courts of appeals and to the Supreme Court of the United States. Each court upheld the lower courts’ decision.

What's the Basis for the Decision?

Much speculation has spurted from the IRS’s new avenue of obtaining even more estate tax from successful business owners, even at their death. Pushing this speculation aside, here’s the explanation provided in a hypothetical:

- In the Connelly case, the buy-sell agreement was written for the intended purchase made by the other family member. What if a third-party buyer is allowed to enter the bidding? The third-party buyers may even be willing to pay for the shares based on the full valuation of the business (including the life insurance proceeds).

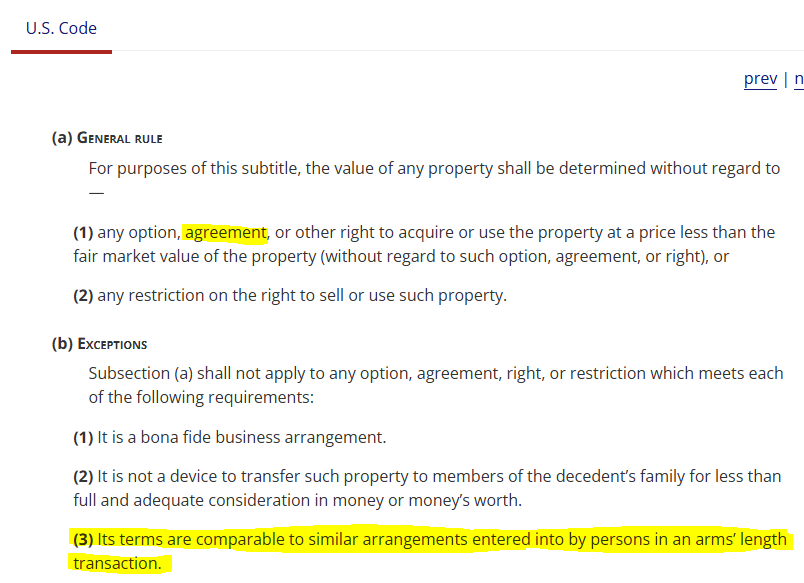

Here’s the US Internal Revenue Code section that puts the nail in the coffin regarding these types of agreements: U.S. Code, Title 26, Subtitle B, Chapter 14, Section 2703

- Subsection (b) Exceptions, line (3)

- “Its (the agreement's) terms are comparable to similar agreements entered into by persons in an arms’ length transaction”

The agreement cannot be written without the consideration of a third party buyer willing to pay full price. Family deals would ensure that the IRS would miss out on the opportunity to collect higher estate tax revenue…

What are the Takeaways?

- Obviously, every business owner MUST create a succession plan.

- Even if you are a sole owner;

- Even if planning to sell your company before death

- If you already have buy-sell agreements in place, you should have them reviewed by your life insurance advisor.

- Like the Connelly’s, your entity-purchase agreement won’t provide enough funds to purchase the intended stake, leaving a mess of unsold shares in your family’s estate.

- Your estate tax liability may be drastically higher than you’ve anticipated.

- The value of your business may have increased, making your existing buy-sell agreements insufficient.

- Not only will you need the right buy-sell mechanism, you should also learn of the best life insurance vehicles that provide adaptability while maintaining tax-deferred growth and access to the policies' cash values.

Business Owners:

If you need advice in creating a succession plan or buy-sell agreement, or if you need us to review your existing agreements, click here.

[Choose Finance & Insurance ]

Business Advisors and Life Insurance Agents:

If you have questions regarding how to address the impacts of this case to your existing or potential clients, or if you're looking to join a team, click here.

[Choose Recruiting]

Read about our Ex-client Rehabilitation Program here: Excel Blue Ocean Strategy