Business News

FCC "Closes the Lead Generator Loophole"

What does it mean for the Life Insurance Industry?

Written by: Paul Bloodsworth

January 3, 2024

[6 minute read]

Life Insurance Industry Gets Shell-Shocked by the FCC

On December 13, 2024, the FCC adopted a rule that will dramatically affect professionals within the life insurance industry. This is not only critical for those engaged in the sales and distribution of life insurance, but this ruling will devastate those who provide lead generation services as well.**

The new rule is set to take effect 6 months after official publication in the Federal Register. So, we're calculating fully effective by June or July 2024.

UPDATE: FCC RELEASED OFFICIAL EFFECTIVE DATE OF 01/25/2025

**The insurance industry is currently taking a 3-way hit heading into 2024... agent procedures, lead generation, and agency overrides!!

And by the way.... Your E&O Insurance does NOT cover TCPA Violations.

Read our article on this topic HERE.

https://go-excel.com/e-and-o-insurance-tcpa.html

In this article, we will highlight 4 major points:

- Why Make the Rule?

- New Restrictions and Disallowed Practices for Lead Generators

- Banned Practices and Risks for Life Insurance Agents

- Definitions of "Prior Express Consent"

Twas 2 weeks before

Christmas in 2023........

and the FCC ruled..

Why Make the Rule?

Business law professors like to explain rule-making by getting students to ask questions regarding the reasoning for laws.

The obvious question is: "Why do we make laws?"

The best answer is simple: "Because people GET MAD..."

So, to understand the FCC and TCPA rules, we must ask, "Who is so angry that the FCC is making rules to mollify their anger?"

Of course, it's the consumers.

Bottom Line: People are fed up with being inundated with unwarranted, unwanted phone calls. Almost daily, American consumers receive multiple solicitation phone calls, including robocalls AND manually-dialed sales calls.

Yes, the DoNotCall Registry was created as an attempt to slow the swarm, but the reality exists that callers use multiple "burner" numbers, or simply ignore the DNC altogether. Many consumers have reported that their unsolicited calls increased after registering on the DNC.

Why doesn't the DNC work? Well, the calling agent doesn't provide legitimate company or personal data to track. The Plaintiff's Bar cannot prosecute a ghost with a burner number. (The sad part is... many telesales agents are coached on how to avoid this...)

IMPORTANT!

However, during a very productive call with the FCC, we were informed that the new December 13th ruling is NOT the only change we'll see. The FCC is apparently working to implement changes in the process by which consumers report violations. No details were given, but it seems that the FCC is also looking to make it more difficult for selling agents to avoid getting charged and prosecuted.

Deeper Discussion? Watch the Video

Paul with Excel Media explains

how the new FCC Ruling affects the Life Insurance Industry

The survey results at the end of the video could be an indicator of what's coming...

Effect on Lead Generation Companies

Lead generation companies will be harshly impacted in more ways than one. Consider their revenue streams:

- Lead sales from running marketing campaigns that provide some kind of form for which the prospect fills out. The prospect's data is sold to an insurance agent who then contacts the prospect.

- Lead sales from redistribution of lead data (aged leads). These leads are sold typically at different price points based on the length of time since the form was originally submitted. (i.e. 30 days; 3 months; 6 months; 12 months; infinity...)

- Live Transfers. A prospect responds to an advertisement by calling in to, or receiving a call from, a call center. The call center agent then conference calls a licensed insurance agent to take over the conversation. The insurance agent is charged for the connection.

Now, with the new ruling, these lead generators are faced with a MAJOR ISSUE...

The new rule requires the consumer provides consent to receive calls or texts on a "one-to-one" basis. This means that the first agent who is in contact with the prospect is the ONLY agent with proper consent, AND the consent is not transferrable. So.. No More Aged Leads??

ANY AGENT WHO CONTACTS THAT PROSPECT AFTER FIRST CONTACT IS NOT IN COMPLIANCE!!

So, how does this affect the above-mentioned revenues streams???

IT MAKES AGED LEADS AND LIVE TRANSFERS NONCOMPLIANT.

2 Major Sources of Revenue... GONE!

Effect on Life Insurance Agents

Life Insurance Agents must become diligently aware of the conditions set forth in this new ruling. Their process of contacting insurance leads will be affected in multiple ways:

- Must obtain "prior express consent." (More on this in the next section below).

- No more purchasing or calling aged leads. When an agent or broker purchases aged leads, there is ZERO chance that he or she is the first agent to contact the prospect. Remember, the prior express consent is given to the first agent ONLY, and the consent is NOT TRANSFERRABLE.

- No more use of auto-dialers . The new rule is very specific regarding robocalling and robotexting. Post COVID, a surge of life insurance agents and brokers are now engaging in telesales. It has become quite common for agents to use autodialing software that calls multiple phone numbers at once while automatically generating "rented" outgoing phone numbers. The new FCC ruling puts an end to this practice.

- No more auto-texting. Although insurance agents do not typically use prerecorded voice messages, many agents and brokers often use "drip campaigns" to automate scheduled text messages directed towards an entire call list of prospects. Unless an agent is using this method to message a prospect has has provided express consent, this practice is also noncompliant.

- Live Transfers. As mentioned in the above section, traditional live transfers are now considered to be noncompliant. However, there is a use case where a live transfer or instant lead can be in compliance. Here's an example:

Remember, the issue lies with the consent.

IF

the call center agent who has first contact with the prospect is working under the same brand name entity as the licensed agent,

AND

the prospect is immediately notified of the agent's name within the marketing campaign, compliance is withheld.

In this case, the consent was given under one umbrella and is considered one entity.

Bottom Line: Aged Leads, Autodialers, Automated text campaings, and Live Transfers are all noncompliant....

What is Prior Express Consent?

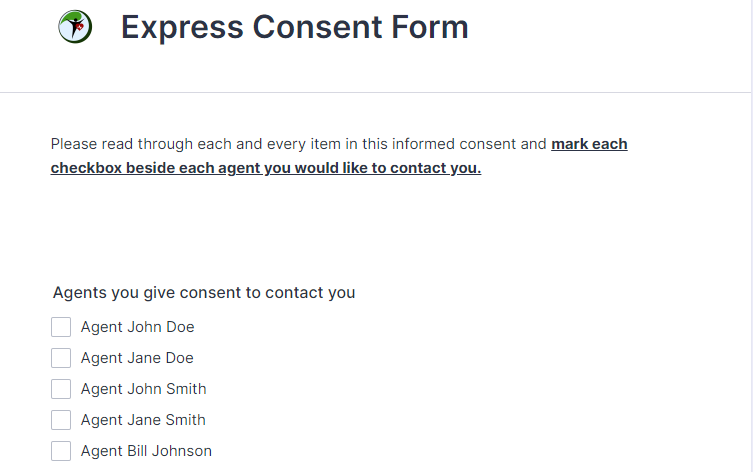

So, how does the FCC define "prior express consent" and how do life insurance agents obtain it? We go over this in our video, but it's good to take note of 3 ways of which to consider:

- Verbal Consent. Simple, right? Someone can verbally and directly give insurance agents express permission to contact them regarding an insurance product or service.

- Written Consent. Not as simple, but not complicated. Written consent is actually provided through a couple of ways.

- First, the lead generator's lead form must include a mandatory checkbox that emphatically informs the prospect that he/she will be contacted by an insurance agent. This consent is solely provided to the first agent who purchases the lead. (The only means by which the lead can be called by multiple agents is IF the form provides each agent's name with individual checkboxes. See video.)

- Second, previous and existing policyholders have provided written consent in their policy contract with the carrier. A privacy policy is included inside the fully executed and signed packet. The privacy policy informs all parties within the contract of the carriers right to contact and share their personal information. So, as long the agent is appointed with that carrier, the consent is valid. It's important to know that the privacy policy offers the option for the policy parties to opt-out of the consent, which usually must be submitted in writing.

- Live Transfers. As mentioned in the previous section of this article, traditional live transfers will become noncompliant. HOWEVER, if an insurance agent and the live call center are working under the same brand name entity, compliance is met.

**For example, if the marketing advertisement provides the specific insurance agent's name with the consent form, and the call center agent is solely representing the insurance agent's agency, the call can be transferred. Basically, both agents are working under the same brand umbrella.

Wrapping Up...

The Life Insurance Industry is about to get rocked by this new FCC ruling. It's predicted that claims will increase dramatically against agents, brokers, IMO's, brokerages, and carriers. A single agent has the potential to trigger a cease and desist order upon an entire organization. New strategies must be developed to offset a forecasted decrease in life insurance production.

Watch the video. At the end, we share an interesting analysis and potential forecast on sales based on our survey results from last year. In the survey, we ask life insurance agents and brokers to let us know which lead type provides the bulk of their written business. Do you think this is an indicator of what's upcoming?...

Excel Media Company

1985 Riviera Dr.

Ste. 103-1034

Mount Pleasant, South Carolina

© All Copyrights 2024 by Excel Media Company, Inc